コンテクスト

- はじめに

- MetaTraderからcTrader、そしてDX.Tradeへ:動き出したトレンド

- なぜシフトするのか?

- コピー・トレーディングを理解する

- cTrader接続におけるFIX APIの役割

- MT4、MT5、cTraderのコピー取引の仕組み

- クロスプラットフォーム・コピートレードの利点

- 簡単な統合:cTraderとcAlgoにおけるFIX API資格情報のナビゲーション

- cTrader FIXシンボルIDの識別

- FIXシンボルIDの検索

- 結論

自己勘定取引(プロップ取引)会社は、従来のメタトレーダープラットフォームであるMT4やMT5から、cTraderやDX.Tradeのような先進的で多機能なプラットフォームへと、プラットフォームの好みが大きく変化している。この移行は、機能強化、透明性の向上、取引条件の改善を提供するテクノロジーを採用する取引業界の広範な傾向を強調するものである。この移行の背後にある理由と、これらの新しいプラットフォームがプロップ取引会社にもたらす利点を掘り下げてみましょう。.

MetaTraderからcTrader、そしてDX.Tradeへ:動き出したトレンド

メタトレーダーの遺産: MT4とMT5は、その使いやすさ、幅広い普及率、豊富なインジケータとExpert Advisor(EA)が評価され、世界中のトレーダーにとって長らく利用されてきたプラットフォームです。しかし、プロップ取引会社は、単なるテクニカル分析ツールや自動取引機能以上のものを提供できるプラットフォームを求めるようになってきている。.

cTraderの魅力: cTraderは、その洗練されたユーザーフレンドリーなインターフェイスと堅牢なチャートツールにより、プロのトレーダーやプロップファームの間で人気を博しています。MT4やMT5とは異なり、cTraderはレベルII価格設定を提供し、トレーダーは流動性プロバイダーから直接執行可能な価格の全範囲を見ることができます。このような市場の可視性の深さは、情報に基づいた意思決定を行い、大量の取引をより効率的に執行するために極めて重要です。さらに、FIX API接続をサポートするcTraderは、他の取引システムやカスタムソリューションとのシームレスな統合を可能にし、運用効率を高めます。.

DX.トレードの出現 cTraderと同様、DX.Tradeも強力な代替手段として台頭しており、プロップファームにカスタマイズ可能で拡張性の高い取引ソリューションを提供している。DX.Tradeは、高度なリスク管理機能、包括的なレポーティングツール、プロトレーダー特有のニーズに応える柔軟性を備えている。その近代的なアーキテクチャーと、セキュリティと信頼性の重視により、競争力を高めるために最先端技術を活用したいと考えているプロップ取引会社にとって魅力的な選択肢となっている。.

なぜシフトするのか?

- 高度な取引条件:cTraderとDX.Tradeはともに、高頻度取引とスキャルピング戦略に重点を置くプロップ企業にとって重要な、遅延とスリッページを低減した優れた注文執行を提供する。.

- カスタマイズ性と拡張性の強化:これらのプラットフォームは、より多くのカスタマイズオプションを提供し、会社の成長に合わせて拡張できるように設計されており、プロのトレーダーが採用する多様な戦略に対応しています。.

- 透明性と公平性:レベルII価格設定などの機能により、トレーダーは市場の透明性を高め、より公正な取引環境を育むことができます。.

- 規制遵守:取引業界における規制の監視が強化されるにつれ、プロップファームは、規制基準の遵守を保証する強固なコンプライアンス機能を提供するプラットフォームに傾倒している。.

MetaTraderプラットフォームからcTraderやDX.Tradeへの移行は、より高度で透明性が高く、効率的な取引技術を採用するプロップトレーディング会社のより広範な傾向を示している。業界が進化し続ける中、優れた約定力、先進的な機能、規制遵守を通じて競争力を提供できるプラットフォームへの需要は高まる一方です。プロップ取引会社にとって、この移行は最新の技術的進歩を活用して取引戦略と業務効率を強化する好機となる。.

オンライントレーディングの進化に伴い、異なるプラットフォーム間でシームレスに取引を実行できる機能は、世界中のトレーダーにとって画期的なものとなっています。今日利用可能な数多くの取引プラットフォームの中で、MetaTrader 4 (MT4)、MetaTrader 5 (MT5)、cTraderは、そのユニークな機能、ユーザーベース、取引機能で際立っています。しかし、トレーダーがこれらのプラットフォームを橋渡しし、単一のエコシステム内だけでなく、MT4、MT5、およびcTraderを横断するコピー取引を可能にしたとき、本当の魔法が起こる。この機能は、cTraderプラットフォームがFIX APIを介して接続されている場合に大幅に強化され、各プラットフォームの強みを活用したい人に堅牢なソリューションを提供します。.

コピー・トレーディングを理解する

コピー・トレーディングは、トレーダーが他のトレーダー(通常は経験豊富なトレーダー)のポジションをコピーすることを可能にする戦略である。これにより、個人はプロの取引を模倣することができ、それによって彼らの専門知識を活用し、自身の取引の成功を高める可能性がある。この戦略を様々なプラットフォームに適用することで、分散投資とリスク管理の新たな機会が生まれます。.

cTrader接続におけるFIX APIの役割

Financial Information eXchange (FIX) APIは、このマルチプラットフォームのコピー取引エコシステムにおいて重要な役割を果たしています。FIX APIを通じてcTraderを接続することで、トレーダーは取引操作において高レベルの安定性、スピード、セキュリティを享受することができます。FIXプロトコルは、金融市場におけるリアルタイムの電子情報交換のゴールドスタンダードであり、シームレスな接続と統合を提供します。.

MT4、MT5、cTraderのコピー取引の仕組み

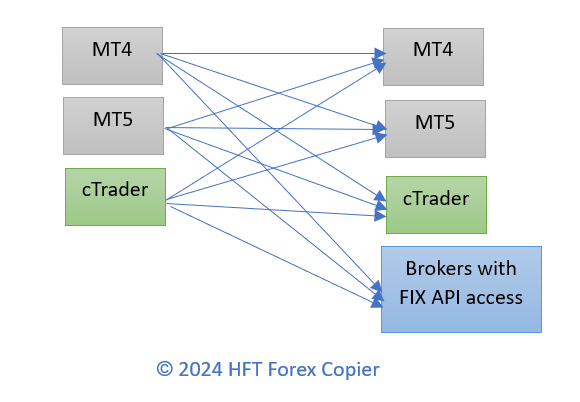

このプロセスは、3つのプラットフォーム(MT4、MT5、またはcTrader)のいずれかからマスター口座を選択することから始まります。マスター口座が選択されると、この口座で執行された取引は、他のプラットフォームの接続されたフォロワー口座に自動的に複製されます。これは、マスター口座の活動を監視し、フォロワーによって設定された事前定義されたパラメータに従って各取引を複製する洗練されたソフトウェアソリューションによって可能になります。.

例えば、MT4口座で成功した取引は、即座にMT5口座やcTrader口座にコピーすることができ、フォロワーは好みのプラットフォームに関係なく戦略の恩恵を受けることができます。FIX API経由で接続されたcTraderがこのエコシステムに含まれることで、市場価格への直接アクセス、待ち時間の短縮、市場への影響を最小限に抑えて大量の取引を執行する能力など、さらなる利点がもたらされる。.

クロスプラットフォーム・コピートレードの利点

- 多様化:トレーダーは、異なるプラットフォームの複数のエキスパートをフォローすることで、戦略を多様化することができる。.

- 柔軟性:プラットフォーム間で取引をコピーできるため、比類のない柔軟性があり、多様なトレーダーの好みや要件に対応できる。.

- アクセシビリティ:特定のプラットフォームの使用に専念している人でも、他のプラットフォームで利用可能な専門知識にアクセスし、その恩恵を受けることができる。.

- 効率性:コピートレーディングのプロセスを自動化することで、時間を節約し、ミスの可能性を減らすことができるため、トレーダーは戦略と分析に集中することができます。.

簡単な統合:cTraderとcAlgoにおけるFIX API資格情報のナビゲーション

cTraderはFIXバージョン4.4と互換性があります。このバージョンに関する詳細な洞察については、FIXプロトコル機構が提供する仕様を以下で参照できます:

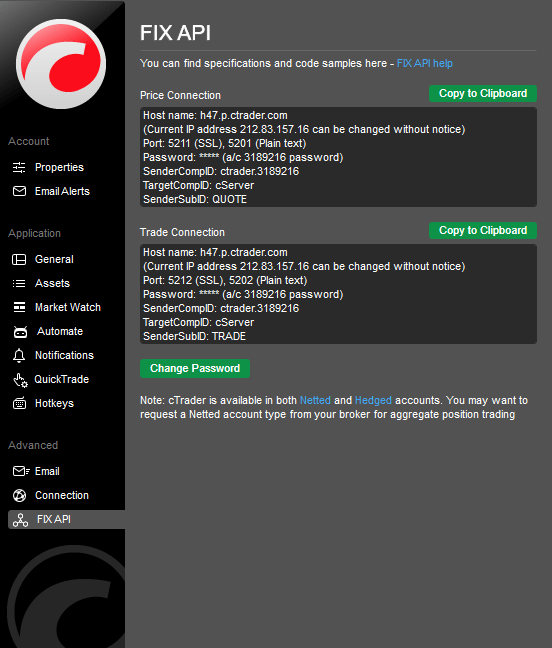

FIX API 認証情報へのアクセスは、cTrader または cAlgo プラットフォーム、特にそれらの設定領域ですぐに利用できます。それらを見つけるには、左下隅にある歯車アイコンをクリックし、設定ドロップダウンメニューのFIX APIオプションに移動します。.

提供される接続には、それぞれ異なるタイプがある:Price ConnectionとTrade Connectionがあり、それぞれ独自の認証情報を伴います。注意すべき点は、Price Connectionの認証情報では取引リクエストを実行できず、同様にTrade Connectionの認証情報では価格データにアクセスできないことです。利便性のため、「クリップボードにコピー」機能が提供されており、必要な認証情報を簡単にコピーすることができます。.

FIX API認証情報のパスワードを更新する必要がある場合は、「Change Password」オプションをクリックするだけで、手続きが開始されます。.

cTrader FIXシンボルIDの識別

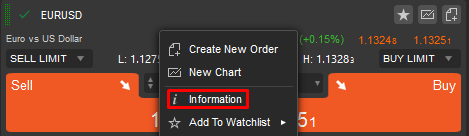

各取引シンボルには特徴的なIDが割り当てられており、FIXメッセージ内での識別に不可欠です。任意のシンボルの FIX シンボル ID を見つけるには、シンボルの情報ペインにアクセスします。これは、Market Watchで目的のシンボルを右クリックし、表示されるメニューから「Information」を選択することで行えます。.

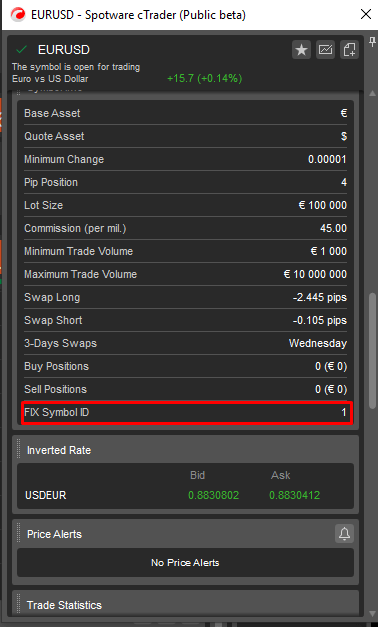

FIXシンボルIDの検索

情報ウィンドウに入ったら、「シンボル情報」セクションに進みます。このエリアを最後までスクロールすると、FIXシンボルIDが表示されます。この一意の識別子は、FIXプロトコル通信でシンボルを正確に参照するために重要です。.

トレーディングの可能性を最大化:HFT Forex Copierのクロスプラットフォームとブローカーの柔軟性

について HFTフォレックス・コピアー は、FIX APIを通じて、MT4、MT5、およびcTraderを含む幅広いプラットフォームにわたって取引をコピーするための比類のないサポートを提供し、汎用性と効率性の新しい基準を設定します。この最先端のツールは、マスター口座とスレーブ口座のどのような組み合わせにも対応できるように設計されており、お客様の取引戦略のためのシームレスな統合と柔軟性を保証します。さらに、FIX APIアクセスを提供するあらゆるブローカーに機能を拡張し、スレーブ口座として機能させることができます。この機能により、トレーダーは様々なプラットフォームやブローカーの強みを活用し、取引結果を最適化できるようになり、可能性が広がります。.

結論

FIX APIのような技術によるMT4、MT5、およびcTraderの統合は、オンライン取引の世界における重要な進歩を意味します。これらのプラットフォーム間でシームレスなコピー取引を可能にすることで、トレーダーは取引コミュニティの集合的な専門知識を活用し、戦略を最適化し、潜在的に取引結果を向上させることができます。テクノロジーが進歩し続けるにつれて、トレーディングで可能なことの境界は絶えず拡大し、トレーダーは投資目標を達成するための新たなツールを提供している。.