Context

- Introduction

- From MetaTrader to cTrader and DX.Trade: A Trend in Motion

- Why the Shift?

- Understanding Copy Trading

- The Role of FIX API in cTrader Connectivity

- How Copy Trading Across MT4, MT5, and cTrader Works

- Benefits of Cross-Platform Copy Trading

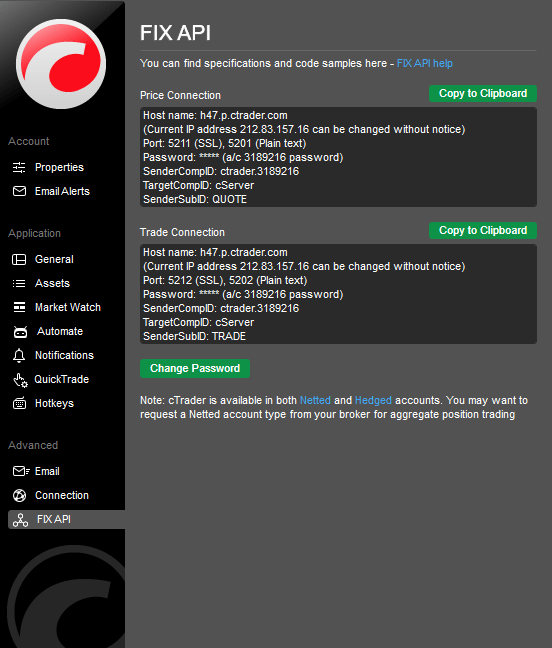

- Effortless Integration: Navigating FIX API Credentials in cTrader and cAlgo

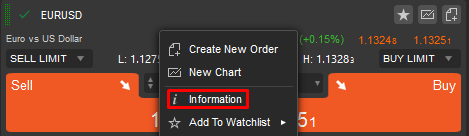

- Identifying cTrader FIX Symbol IDs

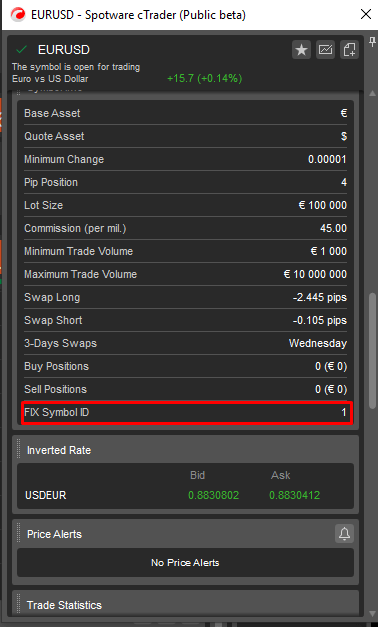

- Locating the FIX Symbol ID

- Conclusion

The landscape of proprietary trading (prop trading) companies has witnessed a significant shift in platform preference, moving away from the traditional MetaTrader platforms, MT4 and MT5, towards more advanced and versatile platforms like cTrader and DX.Trade. This transition underscores a broader trend in the trading industry towards embracing technology that offers enhanced functionality, greater transparency, and improved trading conditions. Let’s delve into the reasons behind this shift and the advantages these newer platforms bring to prop trading firms.

From MetaTrader to cTrader and DX.Trade: A Trend in Motion

MetaTrader’s Legacy: MT4 and MT5 have long been the go-to platforms for traders worldwide, lauded for their ease of use, wide adoption, and extensive range of indicators and Expert Advisors (EAs). However, prop trading firms are increasingly seeking platforms that can provide more than just technical analysis tools and automated trading capabilities.

cTrader’s Appeal: cTrader has gained popularity among professional traders and prop firms for its sophisticated, user-friendly interface and robust charting tools. Unlike MT4 and MT5, cTrader offers Level II pricing, allowing traders to see the full range of executable prices directly from liquidity providers. This depth of market visibility is crucial for making informed decisions and executing large volume trades more effectively. Furthermore, cTrader’s support for FIX API connectivity enables seamless integration with other trading systems and custom solutions, enhancing operational efficiency.

The Emergence of DX.Trade: Similar to cTrader, DX.Trade is emerging as a powerful alternative, providing prop firms with a customizable and scalable trading solution. DX.Trade offers advanced risk management features, comprehensive reporting tools, and the flexibility to cater to the specific needs of professional traders. Its modern architecture and emphasis on security and reliability make it an attractive choice for prop trading firms looking to leverage cutting-edge technology for a competitive edge.

Why the Shift?

- Advanced Trading Conditions: Both cTrader and DX.Trade offer superior order execution, with reduced latency and slippage, which is critical for prop firms focused on high-frequency trading and scalping strategies.

- Enhanced Customization and Scalability: These platforms provide more customization options and are designed to scale with the firm’s growth, accommodating the diverse strategies employed by professional traders.

- Transparency and Fairness: With features like Level II pricing, traders gain a more transparent view of the market, fostering a fairer trading environment.

- Regulatory Compliance: As regulatory scrutiny in the trading industry intensifies, prop firms are leaning towards platforms that offer robust compliance features, ensuring adherence to regulatory standards.

The shift from MetaTrader platforms to cTrader and DX.Trade among prop trading companies signals a broader trend towards embracing more advanced, transparent, and efficient trading technologies. As the industry continues to evolve, the demand for platforms that can provide a competitive edge through superior execution, advanced features, and regulatory compliance will only grow. For prop trading firms, this transition represents an opportunity to leverage the latest technological advancements to enhance their trading strategies and operational efficiency.

In the evolving landscape of online trading, the ability to seamlessly execute trades across different platforms is a game-changer for traders worldwide. Among the plethora of trading platforms available today, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader stand out for their unique features, user base, and trading capabilities. However, the real magic happens when traders can bridge these platforms, allowing for copy trading not just within a single ecosystem but across MT4, MT5, and cTrader. This capability is significantly enhanced when the cTrader platform is connected via the FIX API, offering a robust solution for those looking to leverage the strengths of each platform.

Understanding Copy Trading

Copy trading is a strategy that allows traders to copy positions taken by other, typically more experienced, traders. It enables individuals to mimic the trades of professionals, thereby leveraging their expertise to potentially increase their own trading success. When applied across different platforms, this strategy opens up new opportunities for diversification and risk management.

The Role of FIX API in cTrader Connectivity

The Financial Information eXchange (FIX) API plays a crucial role in this multi-platform copy trading ecosystem. By connecting cTrader through FIX API, traders can enjoy a high level of stability, speed, and security in their trading operations. The FIX protocol is the gold standard for real-time electronic information exchange for financial markets, offering seamless connectivity and integration.

How Copy Trading Across MT4, MT5, and cTrader Works

The process begins with the selection of a master account from any of the three platforms (MT4, MT5, or cTrader). Once the master account is chosen, the trades executed in this account are automatically replicated in the connected follower accounts across the other platforms. This is made possible through sophisticated software solutions that monitor the master account’s activity and duplicate each trade according to predefined parameters set by the follower.

For instance, a successful trade on an MT4 account can be instantly copied to MT5 and cTrader accounts, ensuring that followers benefit from the strategy regardless of the platform they prefer. The inclusion of cTrader connected via FIX API into this ecosystem brings additional advantages, such as direct access to market prices, reduced latency, and the ability to execute large volumes of trades with minimal impact on the market.

Benefits of Cross-Platform Copy Trading

- Diversification: Traders can diversify their strategies by following multiple experts across different platforms.

- Flexibility: The ability to copy trades across platforms offers unmatched flexibility, catering to the preferences and requirements of a diverse trader population.

- Accessibility: Even those committed to using a specific platform can access and benefit from the expertise available on other platforms.

- Efficiency: Automating the copy trading process saves time and reduces the potential for error, allowing traders to focus on strategy and analysis.

Effortless Integration: Navigating FIX API Credentials in cTrader and cAlgo

cTrader is compatible with FIX version 4.4. For detailed insights on this version, you can consult the specifications provided by the FIX Protocol Organization at:

Access to the FIX API credentials is readily available within the cTrader or cAlgo platforms, specifically in their Settings areas. To locate them, click on the gear icon positioned at the lower left corner and navigate to the FIX API option in the Settings dropdown menu.

There are distinct connection types offered: Price Connection and Trade Connection, each accompanied by its own unique credentials. It’s important to note that trading requests cannot be executed through the Price Connection’s credentials, and similarly, price data cannot be accessed through the Trade Connection’s credentials. For convenience, a “Copy to Clipboard” feature is provided, allowing you to easily copy the credentials you need.

Should you need to update the password for your FIX API credentials, simply click on the “Change Password” option to initiate the process.

Identifying cTrader FIX Symbol IDs

Each trading symbol is assigned a distinctive ID, essential for its identification within FIX messages. To locate the FIX Symbol ID for any given symbol, simply access the symbol’s information pane. This can be done by right-clicking the symbol of interest in the Market Watch and selecting ‘Information’ from the resulting menu.

Locating the FIX Symbol ID

Upon entering the information window, navigate towards the ‘Symbol Info’ section. Scroll through this area until you reach the end, where you’ll find the FIX Symbol ID listed. This unique identifier is crucial for accurately referencing symbols in FIX protocol communications.

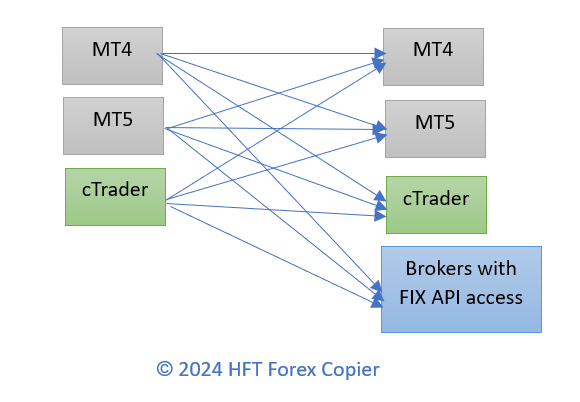

Maximizing Trading Potential: HFT Forex Copier’s Cross-Platform and Broker Flexibility

The HFT Forex Copier sets a new standard in versatility and efficiency, offering unparalleled support for copying trades across a wide array of platforms, including MT4, MT5, and cTrader, through FIX API. This state-of-the-art tool is designed to accommodate any combination of master and slave accounts, ensuring seamless integration and flexibility for your trading strategy. Furthermore, we extend our capabilities to any broker providing FIX API access, allowing them to serve as slave accounts. This feature opens up a world of possibilities, enabling traders to leverage the strengths of various platforms and brokers to optimize their trading outcomes.

Conclusion

The integration of MT4, MT5, and cTrader through technologies like the FIX API represents a significant advancement in the world of online trading. By enabling seamless copy trading across these platforms, traders are empowered to harness the collective expertise of the trading community, optimize their strategies, and potentially enhance their trading outcomes. As technology continues to advance, the boundaries of what’s possible in trading are continually expanded, offering traders new tools to achieve their investment goals.