- What is Forex Copier?

Forex Copier, also known as trade copier or account copier, is a software tool that allows traders to automatically copy trades from one trading account to another. This tool is especially useful for forex traders who want to follow the trading strategies of more experienced traders or signal providers.

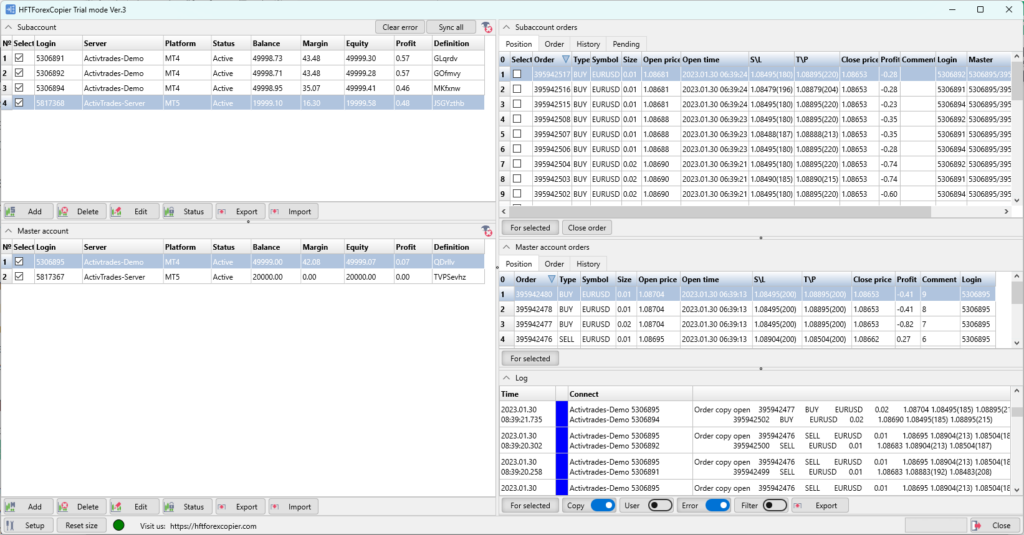

Forex Copiers enable users to replicate the trading activities of a master account (the source account where the trades are executed) into one or multiple slave accounts (the accounts that receive and copy the trades). The copier software can be configured to manage various settings, such as trade size, risk parameters, and currency pairs, allowing users to tailor the copied trades to their preferences.

Some key features of Forex Copiers include:

- Forex Copiers automate the process of copying trades from one account to another, eliminating the need for manual intervention and ensuring that all trades are executed promptly and accurately.

- Users can configure the copier software to match their risk tolerance and trading preferences, such as adjusting the lot size, selecting specific currency pairs, or setting stop-loss and take-profit levels.

- Multi-account management. Forex Copiers can replicate trades across multiple accounts simultaneously, making it easier for money managers or signal providers to manage several clients’ accounts at once.

- Most Forex Copiers provide real-time monitoring of the copied trades, allowing users to track the performance of their accounts and make necessary adjustments.

- Forex Copiers are often compatible with various trading platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), enabling traders to use the software with their preferred trading environment.

Forex Copiers can be a valuable tool for traders looking to learn from more experienced traders, diversify their trading strategies, or simplify the process of managing multiple accounts. However, it’s essential to carefully select the master account or signal provider to ensure the copied trades align with your trading goals and risk tolerance.

- How fast Forex Copier?

The speed of a Forex Copier depends on several factors, such as the quality of the copier software, the configuration settings, the trading platforms being used, and the latency between the master and slave accounts. In general, a high-quality Forex Copier should execute copied trades as quickly and efficiently as possible to minimize slippage and ensure accurate replication of the master account’s trades.

Some factors that can affect the speed of a Forex Copier include:

- A well-designed and efficient Forex Copier should have minimal delays in executing trades. This means that the software should be able to process new trade signals and replicate them across the connected accounts quickly.

- The speed of the copier can be influenced by the user-configured settings, such as trade filters, risk parameters, and the number of accounts being managed. Optimizing these settings can help improve the copier’s performance and execution speed.

- The trading platform used by the master and slave accounts can impact the speed of trade execution. For example, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular trading platforms that are typically compatible with most Forex Copiers. These platforms are known for their stability and performance, which can contribute to a faster trade copying process.

- The time it takes for trade signals to travel between the master and slave accounts can affect the speed of the Forex Copier. This is particularly important in high-frequency trading (HFT) or scalping strategies, where even a slight delay can impact the profitability of the copied trades. To minimize latency, it’s essential to choose a Forex Copier that uses fast and reliable communication protocols, and to ensure that the master and slave accounts are hosted on servers with low latency.

While the speed of a Forex Copier can vary, it’s crucial to select a reliable and efficient software solution that can execute trades promptly and accurately. This will help ensure that the copied trades closely mirror the master account’s performance, maximizing the potential benefits of using a Forex Copier.

- Can I use a Forex Copier for prom firms?

Yes, you can use a Forex Copier for prop (proprietary) trading firms, provided that the firm allows the use of such software and it adheres to their specific trading rules and regulations. Prop trading firms typically provide traders with capital to trade in the financial markets, and they share the profits generated from the trades.

Using a Forex Copier in a prop trading firm can have several advantages:

- A Forex Copier can help maintain consistency in trading strategies by replicating trades from a master account (which might belong to a more experienced or successful trader) to the prop firm’s accounts. This can improve the overall performance of the prop firm’s trading portfolio.

- Forex Copiers often come with features that allow users to adjust risk parameters, such as lot size and stop loss levels. This enables prop firms to manage risks more effectively across multiple trading accounts.

- By using a Forex Copier, prop firms can copy trades from multiple master accounts, which can lead to better diversification and potentially improved overall performance.

However, before using a Forex Copier in a prop trading firm, it’s essential to:

- Confirm that the prop firm allows the use of Forex Copiers and complies with their specific trading rules and regulations.

- Understand the terms and conditions of the prop firm, including profit-sharing arrangements and any restrictions on trading strategies or software.

- Choose a reliable and efficient Forex Copier that is compatible with the trading platforms used by the prop firm and supports the required features for trade replication and risk management.

- Test the Forex Copier on a demo account before deploying it on a live trading environment to ensure its functionality and compatibility with the prop firm’s trading platforms and rules.

In summary, using a Forex Copier in a prop trading firm can be beneficial for improving consistency, risk management, and diversification. However, it’s essential to confirm that the prop firm allows the use of such software and to understand their specific trading rules and regulations before implementing the Forex Copier.

- Can I use HFTForexCopier for copying from MT4 or MT5 to DXTrade Platform?

Yes, you can use HFTForexCopier to copy trades from MT4 or MT5 to the DXTrade platform. HFTForexCopier is designed to support cross-platform trade copying, making it suitable for transferring trades between different trading platforms including MT4, MT5, and DXTrade. This functionality allows traders to manage and execute their trading strategies across various platforms effectively, enhancing flexibility and operational efficiency. Learn more…

- Can I use HFTForexCopier for copying from MT4 or MT5 to MatchTrader Platform?

Yes, you can use HFTForexCopier to copy trades from MT4 or MT5 to the MatchTrader platform. HFTForexCopier is designed to facilitate cross-platform trade copying, enabling traders to synchronize their trading activities across a variety of platforms, including both MatchTrader and the commonly used MT4 and MT5 platforms. This capability is particularly useful for traders who manage multiple accounts or want to apply their strategies across different trading environments efficiently. Learn more…

HFT Forex Trade Copier

The HFT Forex Trade Copier has the lowest possible copying delay and can therefore be used even for high-frequency, scalping, and arbitrage strategies. The HFT Forex Trade Copier is a handy tool for experienced forex traders, forex money managers, and forex brokers as well as for novice traders.

The HFT Forex Trade Copier is compatible with the following trading platforms

- MT 4/5.

- via FIX API, if your broker does not block the FIX API.

- Almost all known FIX API Brokers

Advantages of HFT Forex Trade Copier

The most valuable advantage is possibility to use between different platforms: MT4, MT5, cTrader, FIX API with ultra low delay.

Ultra-fast

High speed of copying.

Multiplatfroms

Copying between different platfroms

Universal

Working both locally and over the internet.

Manual trading

Imitation manual trading for MT 4/5 platforms.

Magic/Comments

Ability to change or overwrite comments and magic numbers.

Hide SL and TP

Possibility to hide Stop Loss, Take Profit and pending orders from the broker.

Money management

Multiple types of lot scaling on sub-accounts.

Copy with Investor password

Only the investor's account number and password are needed for copying

Built-in Filters

Built-in filters allow you to improve copied strategy, and filter orders for copying by numerous attributes (by instrument, comment, magic number, order type...).

Reversal copy

Copying with a reversal.

Pricing Table

Choose which HFT Trade Copier package is more suitable for you

MT4 and MT5 only $145+ Lifetime license

- Lifetime support

- Connectors: MT4 and MT5

MT4, MT5, cTrader $335+ Lifetime license

- Lifetime support

- Connectors: MT4, MT5, cTrader

MT4, MT5, cTrader, FIX API, DXTrade, MatchTrader, NinjaTrader $735+ Lifetime license

- Lifetime support

- Connectors: MT4, MT4, cTrader, FIX API, DXTrade, MatchTrader, NinjaTrader

FAQ about HFT Forex Trade Copier

Execution Speed: The trade copier should provide real-time copying to ensure minimal slippage. Fast execution is crucial, especially in volatile markets.

Broker Compatibility: An efficient MT4 trade copier must be compatible with a wide range of MT4 brokers and accommodate various broker-specific features and tools.

Risk Management Options: The service should offer advanced risk management features, allowing you to control the risk level when copying trades between MT4 accounts.

Customization and Control: The ability to customize settings, such as lot size, filters for choosing which trades to copy, and the option to reverse trades, is vital for a trade copier.

User Interface and Ease of Use: A good MT4 trade copier should have an intuitive interface, making it easy to set up and manage without the need for extensive technical expertise.

Support and Documentation: Adequate support and comprehensive documentation are essential for any trade copier service, ensuring you can troubleshoot any issues that arise.

Reliability and Uptime: The trade copier needs to be reliable with a high uptime to avoid missing trades, which is crucial for maintaining a copy trading strategy.

Security: Ensure the trade copier provides robust security features to protect your trading information and privacy.

Scalability: The MT4 trade copier should work effectively regardless of the size of the operation, from individual traders to money managers handling multiple accounts.

Cost-Effectiveness: Consider the pricing of the trade copier service to ensure it offers good value for money and fits within your trading budget.

Trial or Demo: A service that offers a trial or demo version of the trade copier allows you to evaluate its performance before committing to a purchase.

By focusing on these features, you can select a trade copier mt4 that best fits your trading strategy and helps you manage your MT4 platform more effectively.Efficiency: It automates the process of copying trades from one MT4 account to another, saving traders significant time and reducing manual errors.

Simplicity: The MT4 trade copier simplifies the management of multiple accounts, making it easier for traders to execute the same strategies across various platforms without the need to manually place the same trades on each account.

Scalability: With a trade copier, Forex traders can easily scale their strategies by managing more accounts and increasing the volume of trades, all while maintaining the same level of control and oversight.

Risk Management: Traders can adjust risk settings for each copied trade, ensuring that the trade copier mt4 respects their individual risk tolerance and money management rules.

Diversification: By using a trade copier, traders can diversify their trading strategies across different accounts and brokers, spreading risk and taking advantage of different market conditions.

Learning and Mentorship: Less experienced traders can benefit from copying the trades of more experienced traders, allowing them to learn from their strategies and decisions.

Time Zones and Trading Hours: A trade copier allows trades to be executed automatically at any time, which is particularly beneficial for traders who cannot be active during specific Forex market hours due to time zone differences.

Signal Services: For those who provide or subscribe to signal services, an MT4 trade copier can instantly copy signals to their account, enabling immediate action on trading opportunities.

In essence, an MT4 trade copier offers a mix of efficiency, risk management, and strategic advantages that can lead to a more streamlined and potentially more profitable Forex trading experience.Platform Specificity: An MT4 trade copier is designed exclusively for the MetaTrader 4 platform, ensuring seamless integration with MT4's features and functions. A standard trade copier may be designed to work with various trading platforms and might not offer the same level of integration with any specific platform.

Functionality and Features: MT4 trade copiers often come with features tailored to the MT4 environment, such as support for Expert Advisors (EAs) and custom indicators that are unique to MT4. A standard trade copier might have a more generic set of features to maintain compatibility across different platforms.

Ease of Setup and Use: An MT4 trade copier is likely to be more user-friendly for those who are already familiar with the MT4 interface, potentially offering a more intuitive setup and user experience for MT4 users.

Broker Compatibility: While MT4 trade copiers are designed to work with MT4-supported brokers, standard trade copiers may offer a broader range of broker compatibility, including non-MT4 brokers.

Customization: MT4 trade copiers might offer customization options that are specific to the MT4 platform's capabilities, such as copying trades based on certain signals generated within MT4. A standard trade copier might have a more basic set of customization options.

Latency: An MT4 trade copier may be optimized for low latency within the MT4 ecosystem, which is crucial for fast and accurate trade execution. A standard trade copier's performance in terms of latency might vary depending on the platforms and brokers involved.

Support and Updates: Given the popularity of MT4, an MT4 trade copier might receive more frequent updates and dedicated support, particularly for common issues faced by MT4 users.

In summary, an MT4 trade copier is specifically optimized for MetaTrader 4, making it an ideal choice for traders who use this platform extensively, while a standard trade copier offers a more flexible solution for those who trade on multiple platforms or do not use MT4.Choose a Trade Copier: Select a trade copier service that is compatible with MT4 and meets your trading requirements.

Install the Software: Download and install the trade copier software on your MT4 platform. This typically involves copying and pasting the program files into the MT4 directory on your computer.

Set Up Master and Slave Accounts: Determine which MT4 accounts will be the 'master' (the account from which trades are copied) and which will be the 'slave' (the account to which trades are copied). You will need to install the trade copier software on both accounts, often with different settings for the master and slave roles.

Configure the Copier Settings: Access the trade copier settings within MT4's 'Expert Advisors' section. Here, you can configure various options such as lot size, risk management, which trades to copy, and other parameters.

Test the Connection: Once configured, use a demo or a live account to test the connection and ensure that trades are being copied accurately from the master to the slave account.

Monitor and Adjust: After the initial setup, monitor the trade copier to ensure it is functioning as expected. Adjust the settings as needed based on performance and your risk preferences.

Ensure Stable Internet Connection: Since the trade copier will operate over the internet, ensure that both the master and slave MT4 platforms have a stable and constant connection to avoid missed or delayed trade copying.

Consult the Manual or Support: If you encounter any issues or have specific questions, consult the user manual provided with your trade copier software or reach out to their customer support.

Remember to always start with a demo or small trade sizes to ensure that the copier is working correctly before moving on to larger trades. It is also important to keep in mind that automated systems should be used with caution and monitored regularly to prevent unintended trading actions.Testimonials

It is really good software if you need to copy orders to a lot of sub-accounts. I am using software since 2019 and happy with it.

Iliya T.Forex signal provider

it is most useful and fast trade copier which I tried before. Excellent customer support. My personal recommendations.

Barry F.Forex money manager

Excellent accounts copier for MT4 and MT5. Easy to install and adjust. It is almost 0 delay trade copier.

Garry A.Trader

Forex Copiers WIKI

Our articles about Forex Trade Copier

You can find useful information about HFT Trade Copier, setup, usage, and some tricks and advice from our team.

Effectiveness in Prop Trading: The Role of MT4 to DX Trade and MatchTrader Copiers

In the world of prop trading, where speed and accuracy are key to success, traders...

Bridging Platforms: The Power of Copy Trading Across MT4, MT5, and cTrader

Context The landscape of proprietary trading (prop trading) companies has witnessed a significant shift in...

Trade Copier for Prop Firm Challenges: Navigating MT4, MT5, FTMO, and Prop Trades

In the world of trading, a trade copier is an invaluable tool that allows a...